Adjust your monthly cash flow for higher Part B premiums and IRMAA

On October 12, 2023, the Centers for Medicare and Medicaid Services announced the rates for the 2024 Medicare Part B premiums. They also issued associated income-related monthly adjustment amounts—better known as IRMAA—for Medicare Parts B and D. And an assortment of other costs, copays, and deductibles.

Medical Costs Rising Faster than Overall Inflation…Again

Starting in January 2024, those who get their health insurance from Medicare will pay more for Part B. Nearly $10 per month more for the standard premium. Monthly premiums will increase from $164.90 in 2023 to $174.70 in 2024.

That’s a 5.9% increase. Ouch.

By comparison, the year-over-year (September 2023 vs. September 2022) Consumer Price Index for all items is up 3.7%. See more details on the Bureau of Labor Statistics website (bls.gov/cpi/).

2024 Medicare Part B Premiums: 3 Levels of Costs to Plan For

Level 1: Approximately 92% of people on Medicare only pay the standard monthly premium for Part B. Again, that is $174.70 in 2024.

Level 2: For those seniors who have high incomes in retirement, they pay the standard level plus more. The “plus more” amounts are IRMAA.

High-income folks are identified based on the income they reported on IRS form 1040 or 1040-SR from two years ago. If their adjusted gross income (AGI) plus any non-taxable income from the front of their 1040 exceeds the income thresholds, they pay more for Part B.

Income in retirement can change from year to year and may include any of the following types of cash receipts:

- distributions from IRAs, 401(k)s, 403(b)s, and other employer retirement plans

- interest, dividends, and capital gains

- pension or annuity payments

- Social Security gross payments (up to 85%)

- and other income as defined by the US Tax Code.

Income considered for Part B premiums is before any deductions are applied. Whether someone pays up-charges is based on adjusted gross total income. Not taxable income.

Take a look at the 1040-SR to see which lines apply to you for income each year.

Everyone Must Pay the “Level 3” Medicare Part B Cost

Level 3: The last piece to Part B premiums and other charges is the annual deductible. Nearly 100% of Part B beneficiaries pay this out-of-pocket charge (unless qualifying for certain low-income subsidies). In 2024, each Medicare beneficiary will pay the first $240 when they use Part B services. Last year, this deductible was $226.

This is a once per year payment. Those on Medicare will be billed their share of costs if they see a doctor or specialist, buy durable medical equipment, receive outpatient services, or use other approved healthcare services not covered by Part A. Up to $240. Depending which service they use first, that group will bill the patient for the annual deductible.

The total annual cost for 2024 Medicare Part B is therefore: $2,336.40. Plus any additional amount for IRMAA.

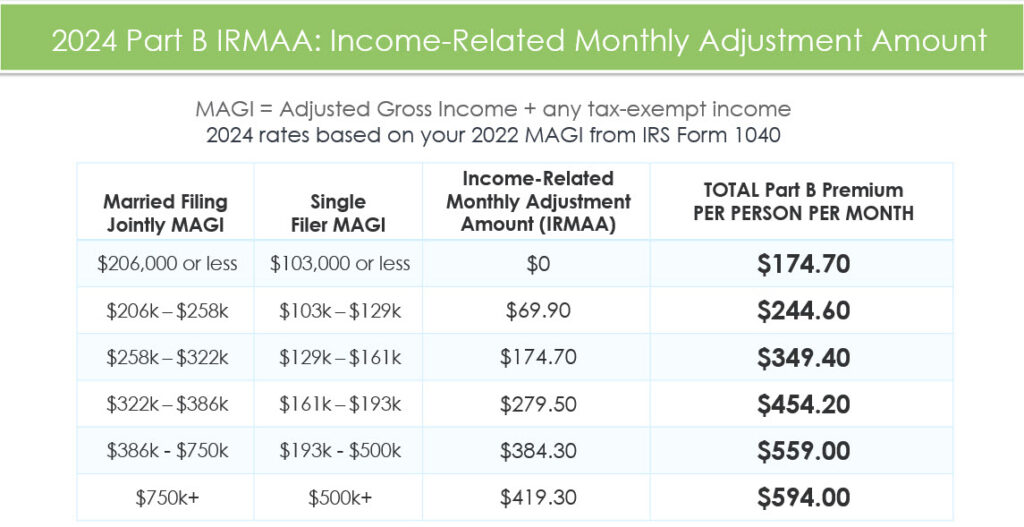

Part B IRMAA Up-Charges and Income Limits

Each year, both the income tiers and the income-related monthly adjustment amounts change. They are indexed for inflation. The top tier is relatively fixed at this time:

- For married taxpayers filing a joint return, if their income is equal to or greater than $750,000, they pay the maximum Part B and Part D IRMAAs.

- For single filers, their income must be equal to or greater than $500,000 before they pay the maximum premium.

Here is the IRMAA Table for the 2024 Medicare Part B Premiums:

If a married couple lives together but files separately, there is a different IRMAA amount each spouse will be assessed:

- MAGI is less than or equal to $103,000, no additional Part B charge. Monthly rate is $174.70.

- MAGI is greater than $103,000 and less than $397,000, IRMAA up-charge is $384.30, and the total monthly premium is $559.00.

- MAGI greater than or equal to $397,000, IRMAA up-charge is $419.30, and the total monthly rate is $594.00.

For additional details about the 2024 IRMAA rates, and new tables for those eligible for immunosuppressive drug coverage only (after kidney transplant) can be found on the CMS website.

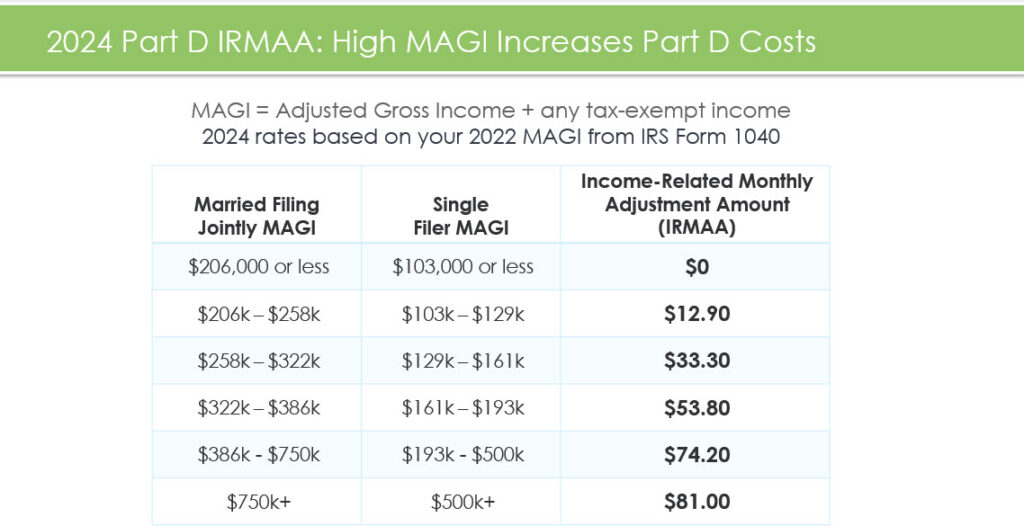

2024 Medicare Part B IRMAA Comes with a Part D IRMAA, Too

When a Medicare beneficiary’s income falls into an IRMAA tier for Part B, this person is also subject to an IRMAA for Part D coverage. The monthly amounts are automatically deducted from their Social Security payments and paid to Medicare. Part D IRMAAs do not go to the private insurance company that provides the Part D plans.

Part D IRMAAs are much lower, but still take a bite out of income cash flow from Social Security.

Here is the 2024 Part D IRMAA table:

Any married couples living together but filing separately pay at the highest IRMAA rates:

- MAGI is less than or equal to $103,000, no Part D charge to Medicare.

- MAGI is greater than $103,000 and less than $397,000, IRMAA up-charge is $74.20.

- MAGI greater than or equal to $397,000, IRMAA up-charge is $81.00.

Medicare Part A Costs Only Increased Slightly

Some better news is that individual’s copays under Medicare Part A didn’t change much between 2023 and 2024.

The biggest increase is in the Part A deductible. For those with Medicare Part A, a hospital stay will cost them $1,632 in 2024. This is up $32 from the 2023 rate.

All other Part A payments stayed remarkably close to the 2023 rates. And for those who do not qualify for premium-free Part A, their monthly cost to buy Part A dropped by $1.00 to $505 per month.

For more details, please read the CMS Press Release.

If You Already Get Medicare…

…and also get Social Security benefits. You’ll first see a cost-of-living-increase applied to your Social Security monthly benefit amount. The 2024 COLA is 3.2%. Annual determination letters generally start arriving in early December.

Then, you’ll see your Social Security dollar amount reduced to pay your 2024 Medicare Part B premium. And it’s further reduced for any Part B IRMAA and any Part D IRMAA you owe. Make sure you adjust your cash flow estimates to account for the reduction for the higher 2024 Part B premium.

…but do not yet receive Social Security benefits. Social Security will send you a bill for your new 2024 Medicare Part B premium amounts. You need to pay those premiums in a timely manner. Generally, Social Security will send you a quarterly bill, so the amounts can be significant. Plan accordingly for a cash flow hit each quarter.

You can set up online payments to help ensure you always pay timely. Take a look at the four options available on Medicare’s website.

If You Will Be New to Medicare in 2024, You’re In For Some Surprises!

If you will enroll in Medicare in 2024. Start your research early on Medicare.gov. Then, enroll in Medicare on Social Security’s website: SSA.gov. You’ll need to set up your mySocialSecurity account first. It only takes 10 – 15 minutes to fill out the Medicare application online. Make sure to account for all your healthcare costs, including Medicare Part B premiums, in your budget.

You can print out and use the budget worksheet I use with my clients.

And, of course, you can reach out to me with any questions about the craziness that is Medicare. I might know just where to get a good answer for you!