Let’s face it. If there is anything women know and love, it’s our shoes. We know of the excesses of the rich and famous. So many have closets full of expensive Manolo Blahniks and Jimmy Choos. But many of us “regular” gals have closets full of shoes too. One study calculated the average amount of money women spend on shoes over a lifetime and it’s a lot. We buy somewhere around 268 pairs of shoes between the ages of 18 and 60. That shopping habit costs us an average of $20,000! Clearly, we all know that shoes can really make the outfit.

Won’t you be shopping in retirement?

When you think about it, is there any reason you won’t be shopping for more shoes once you reach retirement? In fact, the answer is no. You’ll have more time on your hands. So, isn’t it reasonable to think that you’ll be doing more things and going more places? Won’t you likely need more shoes (and many other items)? And, it’s not just shoes that we’ll be buying.

Retirement will also provide us with more time to shop for birthday gifts and plan parties for our family and friends. We might be buying more toys and crafts for our grandchildren. If we take up new activities such as golf or yoga or boating, we’ll spend even more. Think about lessons, equipment, clothing, and yes…probably athletic shoes.

We need to plan for the price tags of our shopping sprees

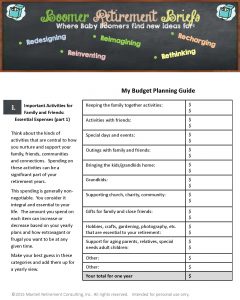

So it’s important to prepare for the reality of shopping throughout retirement. Traditional budget worksheets from financial companies don’t work well for how women spend. Those planning tools are not woman-friendly. They are focused on maintenance items like upkeep on your house or car, taxes, and utilities. Sure, these are all important items. And they certainly need to be included in every retirement plan.

But, women must also take the time to embrace and estimate their personal spending habits. The best way to do that is to define your “essential” (must have) and “discretionary” (nice-to-have) items. Those become the basis for figuring out your retirement income needs.

As you work on your plan, make sure your essential expenses are fully covered every year in retirement. And you get to decide which expenses are essential. Note that your discretionary items must be flexible. They may shift to future years based on certain needs, life events, and the economy.

If you haven’t already, it’s time to sit down and make that list of essential versus discretionary expenses. You may find this budget planning worksheet a good place to get started. Download your free copy.

We define our essential spending

Too often women’s “shopping” or “spending” is overlooked or dismissed in building a traditional retirement income plan. Or, it’s considered discretionary spending.

Yet, money for our essential expenses doesn’t change much once we reach retirement. Think about spending on shoes, sure. But it’s really about providing for our loved ones in big and small ways. And caring for families, friends, and the many connections we’ve made over the years. It’s critical to factor the dollars to support these purchases into our retirement budgets. And consider these expenses “essential.”

So, what do you have on your essential expense list? It’s probably a good time to take a close look… Then, let me know where you will be spending your money in retirement.

For more fun reading take a look at these:

- The estimates for our shoe spending can be found in this article. Read in the Daily Mail Reporter, “A Nation of Shoe Addicts?”

- What’s the Deal With Retirement Planning for Women? In this thought-provoking, but non-traditional, fun approach to planning for a woman’s retirement, I guide women through the key questions they’ll need to answer before they will be prepared to retire.