Another challenging winter in New England. And winter blues across most of the country. Since groundhog day, we held onto hope that the cold and snow and ice would give way to spring. While hunkered down at home, we could have been budgeting for retirement and dreaming of those future days. But, if you’re like most, you spent time watching TV after shoveling snow.

But, finally! Spring arrived and is summer is right on its heels. That means it’s time to pull out the trusty grill and get ready for some backyard barbeques. There is nothing tastier than a really good hamburger smothered in cheese, grilled to perfection. Or chicken that gets that smoky flavor, making even store-bought barbeque sauce taste delicious. Roasted red peppers and grilled asparagus are favorites for my vegetarian daughter. Basically, we find that we can put just about anything on the grill and it tastes much more delicious. Added bonus: there is less to clean up and I get to cook outdoors. What could be better?

The simplicity, ease and convenience of outdoor cooking cannot be underestimated. It’s such a challenge to get a healthy, delicious dinner on the table after a long day. So anything that makes this daily chore easier, quicker and simpler is more than welcome.

This same ease and convenience can also be applied to other spring chores, especially on the financial front. Now that tax season is over, spring is an ideal time to pull together a quick and simple budget for the rest of the year, making sure that you keep focused on budgeting for retirement. Before heading out for summer vacations, it’s a good idea to put a plan in place that you will actually use for the rest of the year.

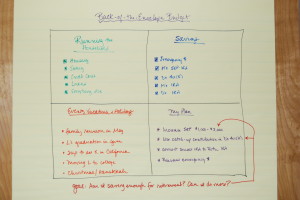

Lots of people complain that it’s hard to do a budget. Well, let’s make it easier! I highly recommend a “back-of-the-envelope” approach that is much simpler and won’t take too long. In fact, it shouldn’t take any longer than the time to make dinner on the grill. You just need a few ingredients, a piece of paper and a pencil. Here’s how to create a sure-to-be-useful budget:

- Grab a copy of your latest bank statement and major credit card statements – these give you the best view of how you are spending the majority of your household budget

- Take a look at your most recent paycheck stub to remind yourself how much you are socking away for retirement – we’ll see in a minute if you can increase that amount

- Now it’s time to use that paper and pencil. Split the paper into 4 sections and label them:

- Running the Household

- Savings

- Events, Vacations and Holidays

- My Plan

- In the first box, “Running the Household”, write down your 4 highest spending categories and total up how much you spent in them over the past month – estimates are just fine! Lump all other expenses into an “everything else” category. The goal is to segment your spending into a few major groups and get a realistic tally of how much you are spending each month. To keep it simple, I suggest these categories:

- Housing (everything here – mortgage/rent/taxes/utilities/technology, etc.)

- Eating (groceries and dining out)

- Credit Card payments (approximate amount you pay each month)

- Loans (car payments, school loans, college tuition, etc.)

- Everything else (in a lump sum)

- In the “Savings” box, write down how much you are saving in your emergency fund and for retirement. It’s not how much you should be setting aside, just the dollar amount of how much you are actually saving. For retirement, include 401(k)s, 403(b)s, 457s, small business plans and IRAs. Anything that you are saving in a tax-deferred account.

- For the “Events” box, make note of upcoming events, holidays or special occasions for the year. How much are you setting aside to cover the expenses related to these activities? Try to earmark enough savings in advance of your events that you don’t have to use credit cards and increase your debt.

- In the last box, “My plan”, write down 3 – 4 financial changes you would like to make for the rest of the year. It might be to increase your retirement savings by 1% when your next raise comes in. Or, you might want to reduce credit card debt. Maybe you can double your emergency fund or save more for vacation. These changes can be big or small. Make them simple to do.

We boomers have been running households for a long time. But, we may not be taking full advantage of “automatic” ways to be financially successful. The more you can “auto” fund your budget, the more success you are likely to have. If you are increasing your retirement savings, make the change right away online or tomorrow morning at your benefits office. Change your paycheck to automatically direct a larger portion of your pay into your savings account for emergencies or events. “Auto pay” your credit cards each month with a pre-set amount so you don’t miss a deadline, or change your auto-pay amount to pay down more of your debt.

Juggling your household expenses while saving for other items and retirement may not be that easy. The key to success is making the time to set up your budget, determining the actions you want to take, and sticking to a simple plan. So, fire up the barbeque then find a shady place in your backyard to jot down your back-of-the-envelope budget. Really, it’s not so hard!

If you prefer more detailed online tools, here are a few you might find helpful when you are budgeting for retirement…and everything else:

- HelloWallet – while this comes with an annual fee, it has an interesting twist – part of your fee goes to free access to the planning tool for lower income folks. (No longer in business.)

- Smartsheet – for Excel spreadsheet lovers, a next generation Excel spreadsheet with way more cool features in the format we already know

- Simple Planning – interesting site with lots of budgeting information and tools for those who want more budget detail