Have you noticed how every month is a National “something” month, and how every day has become a national “something else” day? Many bring awareness to a topic and breaks through the clutter of too much of everything. Other times, these national <fill in the blank> days are just silly and add humor to a long day. Whatever you think of them, they have become part of the fabric of our social media lives. And April is chock-full of everything financial month.

So many “everything financial month” days in April

Obviously, we all know April 15th is tax day. So, most folks are tuned in to something financial in April. But now, there are so many financial “celebratory” days in April.

I first noticed that April is National Financial Literacy Month. We definitely need more literacy to navigate the complex financial systems and products in America today. Turns out, April was officially designated as National Financial Literacy Month way back in 2004 by the U.S. Senate! The year earlier in 2003, the Senate formally recognized that our kids weren’t as financially savvy as they need to be. The result was naming April Financial Literacy for Youth Month.

Then, it was announced that the first week in April is National Retirement Planning week. That sounds great for someone who does retirement planning for a living. This kind of concentrated focus on retirement is key to our long-term financial security. I had another surprise a few weeks ago. The Social Security Administration named their first ever National Social Security month. It’s in April, too.

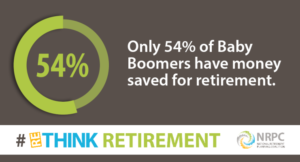

Use April to take a good look at your retirement savings

When thinking ahead to retirement, it is a great idea to take a fresh look at your financial household. April is a particularly good time to take a comprehensive look at your savings. Also include your debt situation and your plans for retirement. You’re likely focusing on finances anyway as you review all those documents in time to file your taxes. (April 18th in 2017 is “tax” day, right?) There are good resources you can use to evaluate your current situation. And, it’s always important to know what’s new about the retirement system.

There are some questions you might want to figure out the answers to as you think about your retirement:

- How much will my Social Security check be?

- If I save 2% more from now until retirement, how much better off will I be?

- What is the earliest time I can retire and feel confident that my money will last 20 or 30 years or more during retirement?

- Can I pay off my mortgage before I retire and what will it take to make that happen?

- Once I’m 70 ½ and all my income sources are coming in, how much will my annual paycheck be and what will the tax implications be?

How interesting that all of these financial topics are the theme of April, which is more typically known as tax season. Of course, April kicks off with the always popular and long-lived April Fool’s Day. Hmmm… is there a connection here?

More fun April celebratory days

Social Security and Retirement Planning are sharing the month with a wide range of other national days. There’s National Equal Payday which moves each year, but is generally around April 4th or 5th. As I embrace my Scottish heritage, it was exciting to see April 6th was National Tartan Day. National Teach Children to Save Day is on April 28th. On April 11th we Boomers can reminisce about the good old days, as it is National 8-Track Tape Day. (Yes, really!)

It’s always fun to see the food days that are part of this National awareness. We have April 6th as Caramel Popcorn Day. On April 18th you could pay your taxes and celebrate Animal Cracker Day. And, April 25th is my younger daughter’s favorite: Zucchini Bread Day. These are all great fun, so grab a snack and get down to business expanding your financial literacy!

For interesting facts and ideas about everything financial month, check out these resources:

And, for my fellow Scottish friends and family, check out National Tartan Day!